Home care margins are razor thin, but there’s a lot you can do to stretch them.

With the average agency keeping around a dime on every dollar, even little changes to drive profitability can go a long way.

Often, these come in the form of mundane administrative changes because they’re the most overlooked.

Let’s talk about seven of those potential changes that might help you earn and save more money.

Tip 1: Make sure you're taking advantage of every available tax deduction

Tax deductions can help you save a lot of money, but you need to ensure that you’re taking advantage of every available deduction. While you’re probably aware of many of these, it’s easy for some of them to slip through the cracks:

- Office supplies: This includes pens, paper, toner, and other items you use in your office.

- Mileage: You can deduct the cost of using your personal vehicle for business-related trips.

- Advertising costs: You can deduct the cost of advertising your services to attract new clients.

- Home Office: If you have a dedicated workspace in your home that you use exclusively for your business, you may be able to deduct a portion of your mortgage, rent, utilities, and other expenses associated with your home office.

- Education and Training Expenses: If you or your employees attend conferences, workshops, or other training sessions related to your business, you may be able to deduct the cost of these expenses.

- Business Insurance: The premiums you pay for insurance policies that protect your business, such as liability insurance and workers’ compensation insurance, are tax-deductible.

- Business Use of Personal Phone and Internet: If you use your personal phone or internet for business purposes, you may be able to deduct a portion of your monthly bill. To do this, you’ll need to keep track of how much you use your phone or internet for business purposes and calculate the percentage of the bill that corresponds to business use.

At the end of the day, always consult with your tax professional on these decisions.

Tip 2: Ensure that you're using the right business tax structure

Choosing the right business tax structure can help you save money on taxes. The two options considered by most home care agencies are:

- Limited Liability Company (LLC): An LLC offers liability protection while also providing flexibility in terms of taxation.

- S-Corporation (S-Corp): An S-Corp can offer additional tax benefits and allow you to pay yourself a reasonable salary while also receiving profits as dividends.

Generally you should start as an LLC and move to an S-Corp when you’re turning enough profits to pay yourself a salary of $70k or more.

To determine the best tax structure for your agency, consult with a tax professional who can help you evaluate the pros and cons of each option.

Tip 3: Ditch paper documentation wherever possible in favor of faster, more efficient online documentation

Online documentation can save you time and money while also improving the quality of your documentation. This is particularly relevant for care plans, shift notes, and care assessments, which can be edited and stored faster and more reliably online.

A few things to keep in mind:

- Choose a HIPAA-compliant system: If your system isn’t HIPAA-compliant, you risk major fines and other consequences in the event of an audit.

- Ensure ease of use: if your team isn’t confident and comfortable using your system, they’re unlikely to maintain consistent, accurate records.

- Provide training and support: Provide training and support for your staff to ensure that they understand how to use the new system. This can include initial training sessions, tutorials, and ongoing support.

- Ensure backup and security: Ensure that your online documentation system has appropriate backup and security measures in place to prevent data loss, unauthorized access, or other security breaches.

Tip 4: Re-evaluate your pricing every six months, if not more often

Re-evaluating your pricing can help you ensure that you’re covering your costs while also remaining competitive. Here are some tips for determining the right pricing strategy for your agency:

- Research your competitors: Look at the pricing strategies of other non-medical home care agencies in your area to get an idea of what’s competitive.

- Calculate your costs: Determine how much it costs to provide your services, including labor, supplies, and overhead costs.

- Consider your profit margins: Determine the profit margin you need to make to keep your agency financially healthy.

tip 5: Consider allowing hybrid or work-from-home options for your office staff

- Increased productivity: Many employees report higher levels of productivity when working remotely, with fewer distractions and more flexibility to structure their workday in a way that suits them.

- Reduced overhead costs: By allowing staff to work remotely, you may be able to reduce your office space requirements, saving you money on rent, utilities, and other office-related expenses.

- Improved staff retention: Offering hybrid work options can help you attract and retain top talent by providing a more flexible and accommodating work environment.

- Enhanced work-life Balance: Hybrid work options can provide your staff with a better work-life balance, allowing them to spend more time with their families or pursue personal interests outside of work. This can widen your talent pool to include working parents or others who might not always be able to be in an office full-time.

tip 6: Use a billing software that allows payers to enroll in auto-pay

Auto-pay can save you time and money while also improving cash flow management. Benefits include:

- Timely payments: with auto-pay, payments are automatically deducted from the payer’s account on the due date, reducing the likelihood of late or missed payments.

- Reduced administration time: auto-pay can help reduce the time and cost of managing invoices, freeing up your staff’s time to focus on other tasks.

- Consistent cash flow: with auto-pay, you can enjoy consistent cash flow, as payments are automatically processed on a regular basis.

- Avoidance of human error: manual billing can be prone to human error, such as mistyping the amount or recipient of a payment. Auto-pay minimizes the risk of these types of errors.

Tip 7: Review your finances monthly, including cash flow, expenses, bank account balance, and forecasted growth

Regardless of whether you’re just starting out or a seasoned veteran, regular financial reviews can help you identify potential issues early on and make informed decisions. For starters, make sure that you:

- Review your cash flow: Look at your inflows and outflows to determine how much money is coming in and going out each month.

- Track your expenses: Keep track of your expenses, including your fixed costs (rent, utilities, etc.) and variable costs (supplies, payroll, etc.).

- Monitor your bank account balance: Regularly check your bank account balance. Any business owner knows how fast the ink in the ledger can turn from black to red.

- Forecast your growth: Use historical data to forecast your growth and keep a pulse on how you’re doing vs. how you planned.

one last suggestion

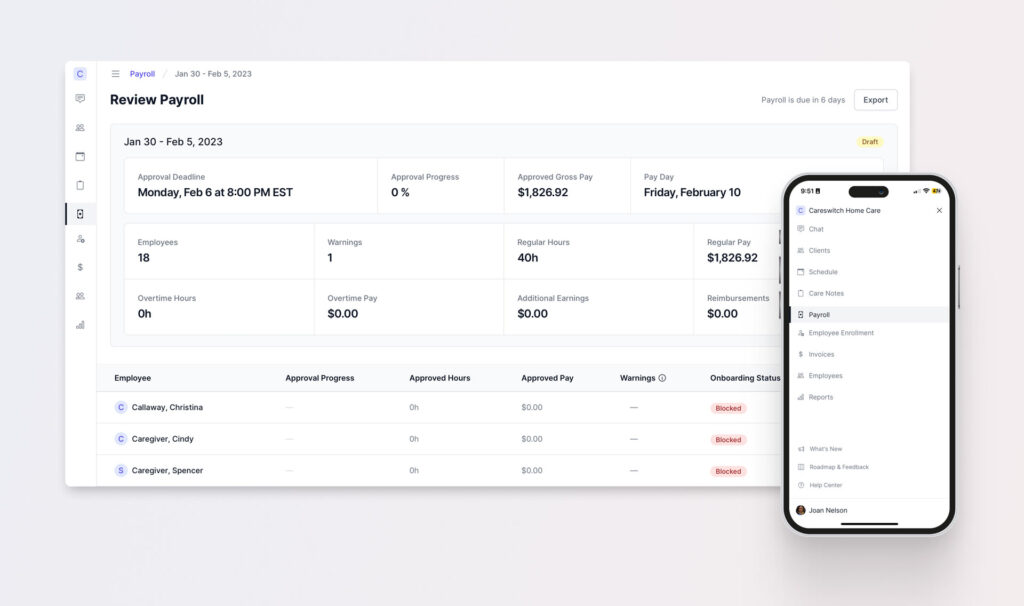

If you’re interested in improving your profitability, check out Careswitch – a new agency management system that includes nearly everything you need to run your business from one place.

We use a freemium pricing model (Google it!), so you can use most of the features for free as long as you want and add paid add-ons like payroll processing when you need them. It’s also designed to be learned in minutes rather than days, unlike most agency management software.

"*" indicates required fields